by jessica | Mar 30, 2016

If you’re anything like me, you’ve got a laptop (or desktop) computer, phone, and tablet (in this case, iPad). And if you’re really like me, your poor iPad has been practically neglected in favor of your computer while at home, and your phone while on the go. I know, I know – that iPad seemed like a good investment at the time, and you probably promised yourself that you’d use it for something other than keeping the kids quiet with Netflix in the car.

Hey, no judgement here.

Dust that guilt off, Rich Friends! (And wipe the smudges off that iPad screen, too.) I’m about to share with you guys my new favorite tool of the moment that has skyrocketed my productivity – and it only cost me 60 bucks!

Last week I bought this Cooper Cases™ NoteKee Bluetooth Keyboard Case for my iPad Air 2 right here on Amazon. At first, I thought buying it would be really cool for travel, or taking notes on the go. But guys, it’s done so much more for me than that. This keyboard case has turned me into a serious coinpreneur on the go!

It’s super thin, and slides into my purse without adding extra bulk of weighing it down. Guys, I travel everywhere with my iPad now., No kidding – I whip it out while getting a pedicure or cup of coffee, and write e-mails, blog posts, business ideas, or even create full-fledged documents just like I would on my laptop.

Listen, typing on an iPad sans keyboard is a pain. It’s cumbersome and slow (and probably why our kids ended up claiming them as mini entertainment centers). But with my keyboard case, I’m so much more productive! It’s like having a second laptop that’s tinier, more convenient, and easier to carry around. But my favorite thing about this case? Two words: backlit keyboard. Have you ever had one of those nights where you tried to go to bed, but thoughts, ideas and to-dos kept you from drifting off to lala land – but at the same time, you absolutely dreaded the idea of going to get your computer? Yep, this keyboard case is the fix for that.

On those nights where I can’t sleep unless I get the ideas out or get the work done, I reach for my iPad and get to typing. The backlight is bright enough for me to see the keys without blinding me, and the tap-tap-tap of the keys is soft enough that I won’t wake the Hubbin.

Talk about a game changer! It takes a device that we’ve already spent hundreds of dollars on, and turns it into a super-efficient, coin-making machine! I get my ideas out quickly and quietly, then drift off to sleep (while those coins roll in).

The Cooper Cases™ NoteKee is my favorite productivity tool at the moment. What’s yours?

by jessica | Mar 24, 2016

The video below is a re-play of a periscope broadcast Nicole Walters delivered on March 23rd, 2016. In this Scope Nicole talks about an a-ha moment she had about a very popular income stream. She credits her new perspective on this income stream to her richfriends. In this video find out what the income stream is and why it’s worth consideration.

*Feel free to use the chapter guide below to skip to your favorite parts!*

Video Chapters

Hubbin’ Intro

0:00 – 1:36

Nicole Walters Intro

1:39 – 3:04

Background Information

3:05 – 6:47

Lesson

6:48 – 22:45

Close

22:46 – 22:51

by jessica | Mar 17, 2016

Rich Friend, can I ask you an honest question? (I’m going to assume you said, “Sure, Nicole! Ask away!)

How much money do you have in your savings account?

Yikes! That escalated quickly.

You guys know I love to be all up in your business – but not because I’m nosy. I’m here to help you crush it, and crushing it is all about action – it’s about taking the time to #dothework.

If your heart started pounding when I asked about savings, it probably means one of two things:

- You’re not saving money as much as you think you need to or;

- You’re not saving money at all.

Don’t get too down on yourself, Rich Friend. According to recent studies, about half of all Americans are saving 5% or less of their income annually. On top of that, another 18% are saving nothing.

What does that mean? It means little to no money in the bank for emergency car or home repairs. It means being financially stuck between a rock and a hard place, should a medical emergency arise. And it also means no fancy yachts.

Chances are, you know you need to save. But there’s a huge difference between knowing that you need to do something, and actually doing it. Saving money can be difficult (trust me, I’ve been there), but once you start cultivating that habit of putting something aside for a rainy day, you’ll be much more at ease and not driven by the urgency of coin when making decisions for your business.

Tight Budget? No Problem.

If you’re feeling like your budget is a little too tight to put away 15% of your earnings every paycheck (or #receipt), I’ve got good news for you – there’s an app for that.

Seriously.

There’s a nifty little app called Acorns, that helps you save while simultaneously creating a stock portfolio. And the best part? You won’t even notice it happening.

Acorns is a mobile app and desktop application that was created to help everyday folks like you and I get a leg up on saving and investing for the future. When you sign up for Acorns, you’re simultaneously creating a savings account and an investment portfolio. Rather than have the money just sit in a traditional savings account and accrue negligible interest, Acorns invests your money into a diversified stock portfolio optimized to help you meet your financial goals.

With Acorns, there are three ways to grow your money:

- You can establish reoccurring deposits to transfer money from your bank account of choice to your Acorns portfolio

- Invest a lump sum into your Acorns portfolio

- Connect your bank account of choice and use their “Round-Ups” feature to grow your portfolio.

With reoccurring deposits, you establish a set amount of money (there’s a $5 minimum) that you’d like to transfer from your bank account to your Acorn, and then select the frequency. You can have reoccurring deposits to your Acorns portfolio daily, weekly, or monthly.

The Lump sum investing option allows you to make a one-time deposit (say, you get a bonus from work) and) put it in your investment portfolio to grow it.

Round-Ups is my favorite, because it takes the coins that round out your debit card transactions to the nearest dollar, and moves them to your Acorn investment account. For example, if you spend $4.37 at Starbucks, $0.63 gets moved to your Acorns portfolio. They essentially round up to the nearest dollar and transfer that amount.

It may seem small and insignificant, but think of all the times you use your debit card on a weekly basis – lunch at work, groceries, coffee runs, gas…the list goes on. Each time you spend, Acorns scrapes those extra coins and puts them aside – and you won’t even notice they’re gone!

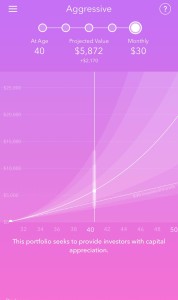

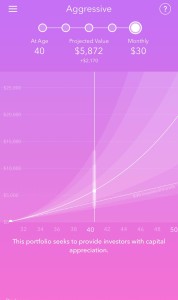

More Than Just Saving

What really sets Acorns apart from other savings solutions is that it’s more than just saving money. Acorn is literally helping you build an investment portfolio. Once you sign up, you’ll be prompted to complete a financial profile that details your employment information, net worth, reason for investing, and time frame to your financial goal. Based on that information, Acorns will make a stock portfolio recommendation ranging from conservative to aggressive. You can choose whichever portfolio best suits your goals.

Guys, this is real deal coin making – happening right now. Some of my Rich Friends have created Acorns accounts with Round-Ups only and saved over $100 in less than 2 months. $100?! Did you realize you had that much spare change rolling around in your account? Me neither!

All you need to get your Acorns account rolling is $5. That’s it guys – 5 bucks. What’s even cooler is that Acorns has a referral program – send your fellow Rich Friends your personalized link, and when they sign up for an account, you each will get $5! You can earn up to $100 in referrals every calendar year (that’s up to 20 Rich Friends and family members). Earn that affiliate coin!

Once you set everything up, just sit back and watch it grow…and breathe a sigh of relief.

Click here to learn more about Acorns and download the app today!

Need to Knows:

Round up transfers don’t happen immediately. Round up amounts need to hit $5 before Acorns can move it from your account – once you reach a number of transactions where the change rounds up to $5 or more, that amount is transferred.

Acorns can only transfer, invest, and round up money from personal accounts – business accounts are not allowed.

When selecting your stock portfolio, Acorns shows projections based on your financial goals to help you decide which portfolio to pursue – but they make no guarantees. It’s just forecasting.

To financially empower the next generation of investors, Acorns is free for students and anyone under the age of 24. For those of us over 24, Acorns fees is really affordable. For accounts valued at under $5,000, there is a $1 monthly maintenance fee deducted from your Acorn. For accounts over $5,000, there’s an annual fee of 0.25%.

by jessica | Mar 1, 2016

Nothing makes me happier than seeing Rich Friends block the broke and denounce doing free. I mean, one of the foundational pieces of The Monetized Life is building a place for people to drop off their money, right? But payments can still be frustrating. How many times did you have to send that same invoice over?

Because I’m all about helping my Rich Friends get their coin, I couldn’t wait to share the news about PayPal.Me – PayPal’s latest and greatest way to automate invoicing and make collecting coin a breeze. With PayPal.Me, all you have to do is send your personalized link and boom! Coin collecting time!

Signing up for your very own PayPal.Me account is super simple and literally takes 10 seconds:

- Go to http://www.paypal.me and click “Get Started”

- Type your custom URL into the box (I recommend using your name) and click “Grab this Link”

- From there you’ll be directed to log in to your PayPal account (you do have one of those, right?)

- Once you log in, simply scroll to the bottom, accept the terms and conditions, and activate your PayPal.Me account.

Easy peasy.

PayPal.Me is useful in all types of situations. Suppose that you get asked to write a blog post or product review. Normally, you’d do the work, send an invoice, and wait. And wait some more. Some folks might be ok with waiting, but not my Rich Friends! Receiving payments in a timely manner is critical to small business operations.

That’s where PayPal.Me comes in handy. Instead of creating an invoice and relying on traditional bank transfers, credit card processors, or a paper check, you can just include your PayPal.Me link in your e-mail, text, or other messaging correspondence. Once your link is sent, all the other person has to do is enter the amount, and approve it. The money moves into your account instantly, and you’re able to put more time into your business as a result.

Because your PayPal.Me address is your own personal link, you can use it virtually anywhere! Text it to your friends. E-mail it to your clients. Heck, even place it directly on your website and Facebook business page (please tell me you have one of those) so those coins can roll in!

While PayPal.Me may not be able to solve all your invoicing problems, it can definitely help streamline at least a portion of your payment transfers. Streamlined = more free time. And you guys know I’m all about efficiency and freeing up time. Less time spent on invoicing means more time being put into your business. More time put into your business means what? More coin opportunities.

Exactly.

by jessica | Feb 29, 2016

As one of my Rich friends you probably already know this, but it’s worth repeating – if you want to get coin like a business, you have to act like a business. All too often, folks lose out on opportunities to earn money by not mastering that single principle. And you guys have no idea how much it breaks my heart to see it happen.

And now you’re probably thinking, “Well Nicole, how do I know if I’ve mastered the art of acting like a business?”

I’m glad you asked!

If you’re acting like a business, then you’re not making these rookie mistakes:

1. Posting on your personal Facebook account (rather than a Facebook Page) about your business.

Quick Fix: Establish one for free for yourself (as a public figure) or for your brand/business.

2. Not having a dedicated website.

Quick Fix: Take 30 minutes to set up a quick free site on WordPress or Squarespace.

3. Commingling business and personal funds in your PayPal account.

Quick Fix: PayPal for Business is free, and you’ll thank me come tax season.

4. Wasting hours creating your own graphics when design isn’t your specialty.

Quick Fix: Get professional graphic work done inexpensively through Fiverr or create something better looking on your own quickly with Canva.

5. Flooding people’s Facebook and Instagram timeline with your products – with no strategy or plan on how to establish and grow your own consumer base. You might see some traction, but are you sure it’s from the right audience? And if Facebook or Instagram disappears, how will you contact this new audience?

Quick Fix: See mistake #2, and create a place (website, business Facebook Page) for your fans to congregate and discuss how wonderful your offerings are. Use your personal timeline to occasionally direct them there.

6. Not having an e-mail list. This is the granddaddy rule – you need an email list. It’s a must. When people buy from you, get their email address.

Quick Fix: MailChimp is free. Do that like, yesterday.

7. Setting unclear goals. Don’t dabble – go hard.

Quick Fix: Set weekly sales goals, inventory, or social media growth goals. Then crush them.

There’s so much FREE information out there, and I’m always here as a resource for you, Rich Friend. However, you guys know I don’t do free – so you don’t have to work with me directly – but please do the work and ACT like a business. Unless of course, you don’t want to get coin like one.