Rich Friend, can I ask you an honest question? (I’m going to assume you said, “Sure, Nicole! Ask away!)

How much money do you have in your savings account?

Yikes! That escalated quickly.

You guys know I love to be all up in your business – but not because I’m nosy. I’m here to help you crush it, and crushing it is all about action – it’s about taking the time to #dothework.

If your heart started pounding when I asked about savings, it probably means one of two things:

- You’re not saving money as much as you think you need to or;

- You’re not saving money at all.

Don’t get too down on yourself, Rich Friend. According to recent studies, about half of all Americans are saving 5% or less of their income annually. On top of that, another 18% are saving nothing.

What does that mean? It means little to no money in the bank for emergency car or home repairs. It means being financially stuck between a rock and a hard place, should a medical emergency arise. And it also means no fancy yachts.

Chances are, you know you need to save. But there’s a huge difference between knowing that you need to do something, and actually doing it. Saving money can be difficult (trust me, I’ve been there), but once you start cultivating that habit of putting something aside for a rainy day, you’ll be much more at ease and not driven by the urgency of coin when making decisions for your business.

Tight Budget? No Problem.

If you’re feeling like your budget is a little too tight to put away 15% of your earnings every paycheck (or #receipt), I’ve got good news for you – there’s an app for that.

Seriously.

There’s a nifty little app called Acorns, that helps you save while simultaneously creating a stock portfolio. And the best part? You won’t even notice it happening.

Acorns is a mobile app and desktop application that was created to help everyday folks like you and I get a leg up on saving and investing for the future. When you sign up for Acorns, you’re simultaneously creating a savings account and an investment portfolio. Rather than have the money just sit in a traditional savings account and accrue negligible interest, Acorns invests your money into a diversified stock portfolio optimized to help you meet your financial goals.

With Acorns, there are three ways to grow your money:

- You can establish reoccurring deposits to transfer money from your bank account of choice to your Acorns portfolio

- Invest a lump sum into your Acorns portfolio

- Connect your bank account of choice and use their “Round-Ups” feature to grow your portfolio.

With reoccurring deposits, you establish a set amount of money (there’s a $5 minimum) that you’d like to transfer from your bank account to your Acorn, and then select the frequency. You can have reoccurring deposits to your Acorns portfolio daily, weekly, or monthly.

The Lump sum investing option allows you to make a one-time deposit (say, you get a bonus from work) and) put it in your investment portfolio to grow it.

Round-Ups is my favorite, because it takes the coins that round out your debit card transactions to the nearest dollar, and moves them to your Acorn investment account. For example, if you spend $4.37 at Starbucks, $0.63 gets moved to your Acorns portfolio. They essentially round up to the nearest dollar and transfer that amount.

It may seem small and insignificant, but think of all the times you use your debit card on a weekly basis – lunch at work, groceries, coffee runs, gas…the list goes on. Each time you spend, Acorns scrapes those extra coins and puts them aside – and you won’t even notice they’re gone!

More Than Just Saving

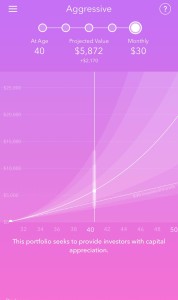

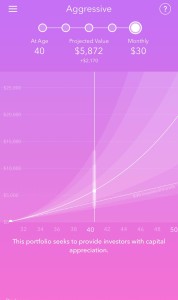

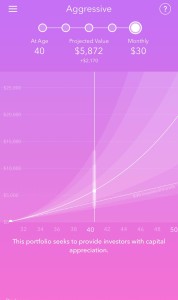

What really sets Acorns apart from other savings solutions is that it’s more than just saving money. Acorn is literally helping you build an investment portfolio. Once you sign up, you’ll be prompted to complete a financial profile that details your employment information, net worth, reason for investing, and time frame to your financial goal. Based on that information, Acorns will make a stock portfolio recommendation ranging from conservative to aggressive. You can choose whichever portfolio best suits your goals.

Guys, this is real deal coin making – happening right now. Some of my Rich Friends have created Acorns accounts with Round-Ups only and saved over $100 in less than 2 months. $100?! Did you realize you had that much spare change rolling around in your account? Me neither!

All you need to get your Acorns account rolling is $5. That’s it guys – 5 bucks. What’s even cooler is that Acorns has a referral program – send your fellow Rich Friends your personalized link, and when they sign up for an account, you each will get $5! You can earn up to $100 in referrals every calendar year (that’s up to 20 Rich Friends and family members). Earn that affiliate coin!

Once you set everything up, just sit back and watch it grow…and breathe a sigh of relief.

Click here to learn more about Acorns and download the app today!

Need to Knows:

Round up transfers don’t happen immediately. Round up amounts need to hit $5 before Acorns can move it from your account – once you reach a number of transactions where the change rounds up to $5 or more, that amount is transferred.

Acorns can only transfer, invest, and round up money from personal accounts – business accounts are not allowed.

When selecting your stock portfolio, Acorns shows projections based on your financial goals to help you decide which portfolio to pursue – but they make no guarantees. It’s just forecasting.

To financially empower the next generation of investors, Acorns is free for students and anyone under the age of 24. For those of us over 24, Acorns fees is really affordable. For accounts valued at under $5,000, there is a $1 monthly maintenance fee deducted from your Acorn. For accounts over $5,000, there’s an annual fee of 0.25%.

This sounds like a really good idea! Thanks for sharing!

I’m so going to try this out. Thank you so much.

Sounds interesting. I want to check this out!